Recent Articles

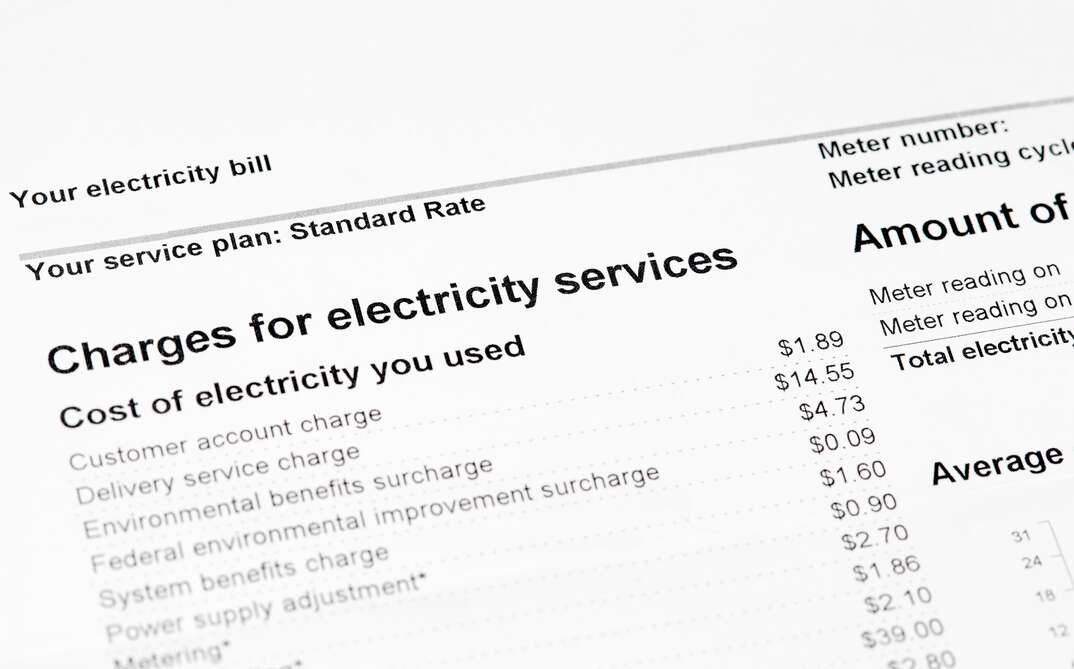

Why Is My Electric Bill so High?

Is your electricity bill much higher this month than it's been in previous months? Discover some reasons your utility cost may have shot up.

Your Guide to an Eco-Friendly Move

Make a move that's a little easier on the earth with eco-friendly techniques, such as using green movers and finding reusable moving boxes. Here are tips to help make your move more “green.”

Will Paying Off My Car Hurt My Credit Rating?

If you’re in the financial position to do so, you may be wondering if paying off a car loan early can hurt your credit. Here are the facts you need to make an informed decision about your auto loan.

What's the Lifespan of an HVAC System?

The reality is that there's no one-size-fits-all answer to the lifespan of an HVAC system. Several factors influence how long it will serve you.

When Should You Start Estate Planning?

Think of estate planning as a way to take control of your assets and estate and make decisions that can provide peace of mind for you and your loved ones. After you learn the basics of estate planning, you’ll understand why starting sooner is always better.

Why Was My Patent Application Denied?

It's not as easy to get a patent as many people think. Knowing the common reasons patent applications may be denied can help you protect your work if your patent application isn't approved.