Recent Articles

What Are the Pros and Cons of Home Water Filtration Systems?

To filter or not to filter? Is a home water filtration system worth the investment? Explore the pros and cons of a home water filter system to decide if you want to install one.

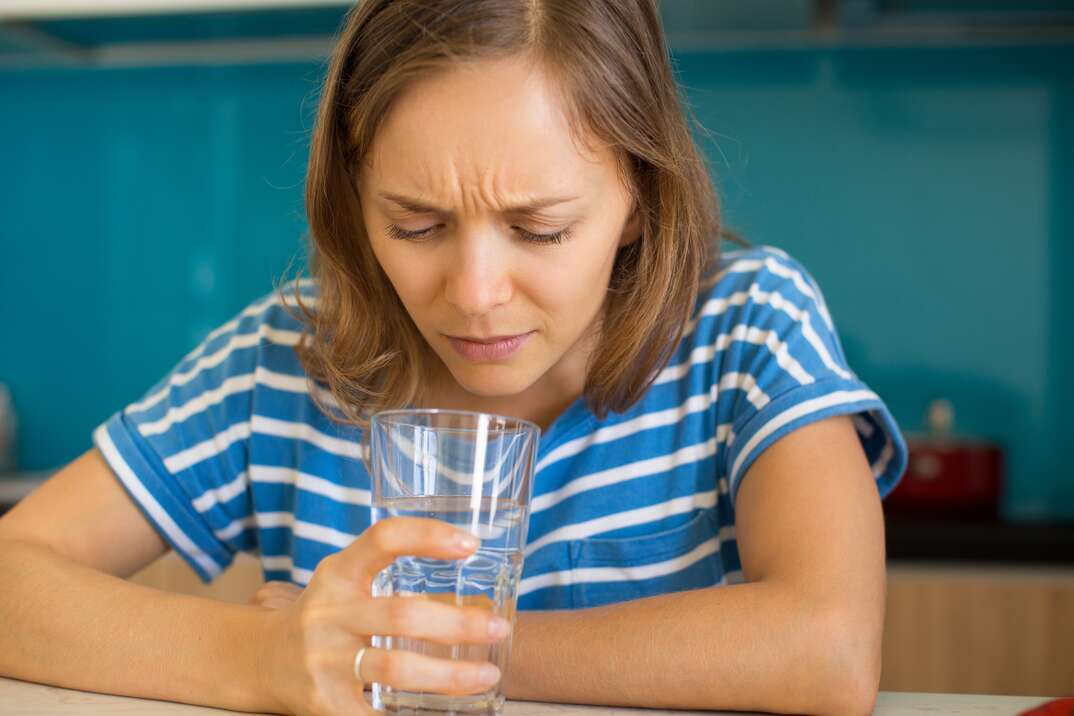

Why Does My Water Taste Metallic?

There can be a number of reasons for metallic-tasting water, so it's important to understand what’s causing it. Learn some common reasons why your water tastes like metal and what you can do to fix it.

How to Budget For a Home Renovation

Tearing down walls and building a new dream space can be exciting, but home renovations are notorious budget-busters. We'll help you avoid going over budget.

Top 5 Methods for Removing Pet Hair

You can effectively manage pet hair on hardwood floors, keeping your home clean and ensuring that your floors are showcased at their best. Here's how.

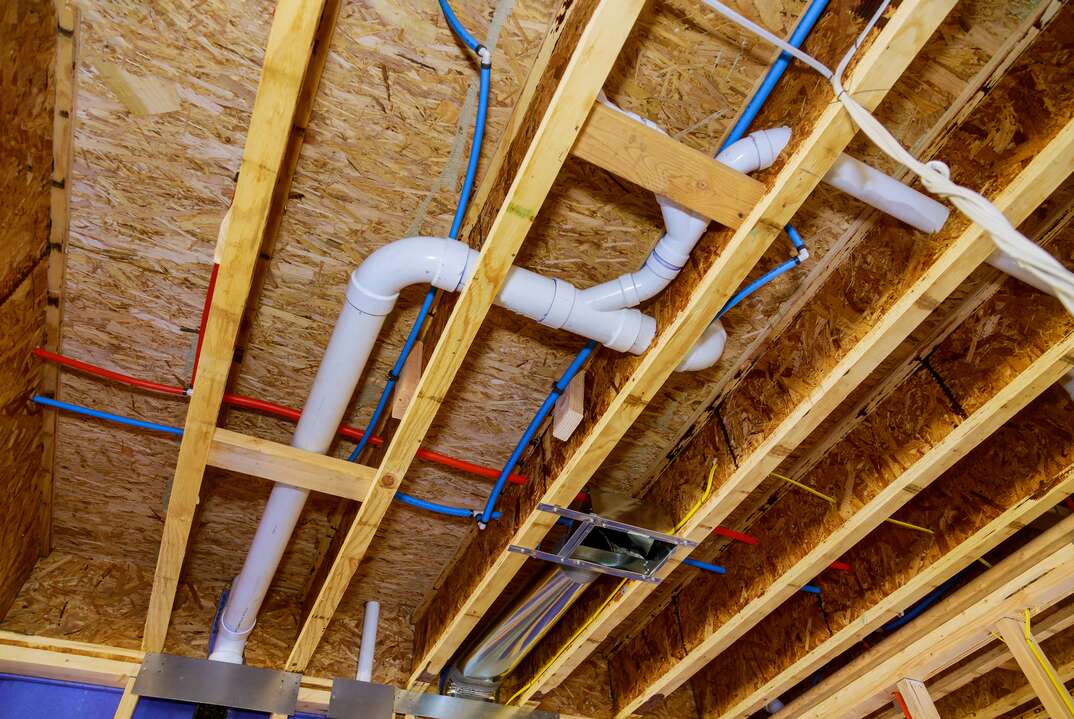

Why Are My Pipes Gurgling?

If your pipes are gurgling, there's definitely something going on with your plumbing that should be addressed. Understanding the different causes of this unique plumbing symptom can help you determine whether the issue can be solved in a DIY fashion or if professional intervention is the best way to go.

Here's What to Know About Tree Root Invasion of Your Water Line

A sink or tub full of backed-up sewage water or a constantly clogging toilet is never a good sign. In severe plumbing situations like these, tree root invasion is often the culprit.