Recent Articles

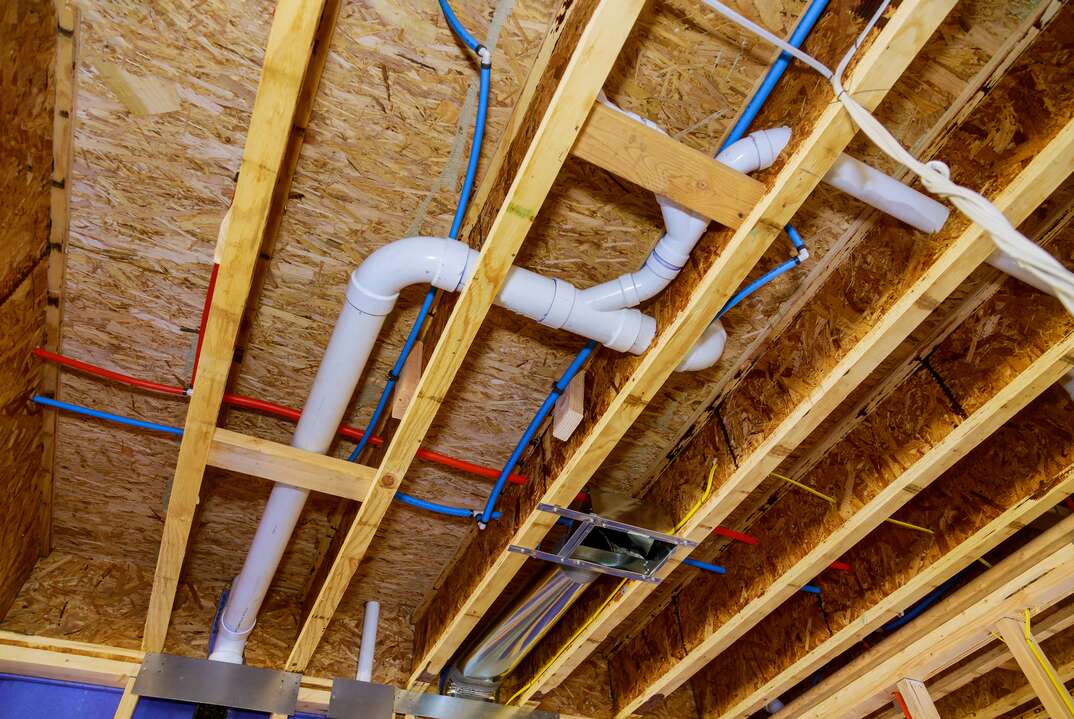

Why Are My Pipes Gurgling?

If your pipes are gurgling, there's definitely something going on with your plumbing that should be addressed. Understanding the different causes of this unique plumbing symptom can help you determine whether the issue can be solved in a DIY fashion or if professional intervention is the best way to go.

Here's What to Know About Tree Root Invasion of Your Water Line

A sink or tub full of backed-up sewage water or a constantly clogging toilet is never a good sign. In severe plumbing situations like these, tree root invasion is often the culprit.

Can I Be Charged With a Crime I Didn't Know Was Illegal?

Yes, you can be charged with a crime even if you didn't realize you were doing something illegal. However, in certain cases, not realizing your actions are criminal may help support your defense strategy.

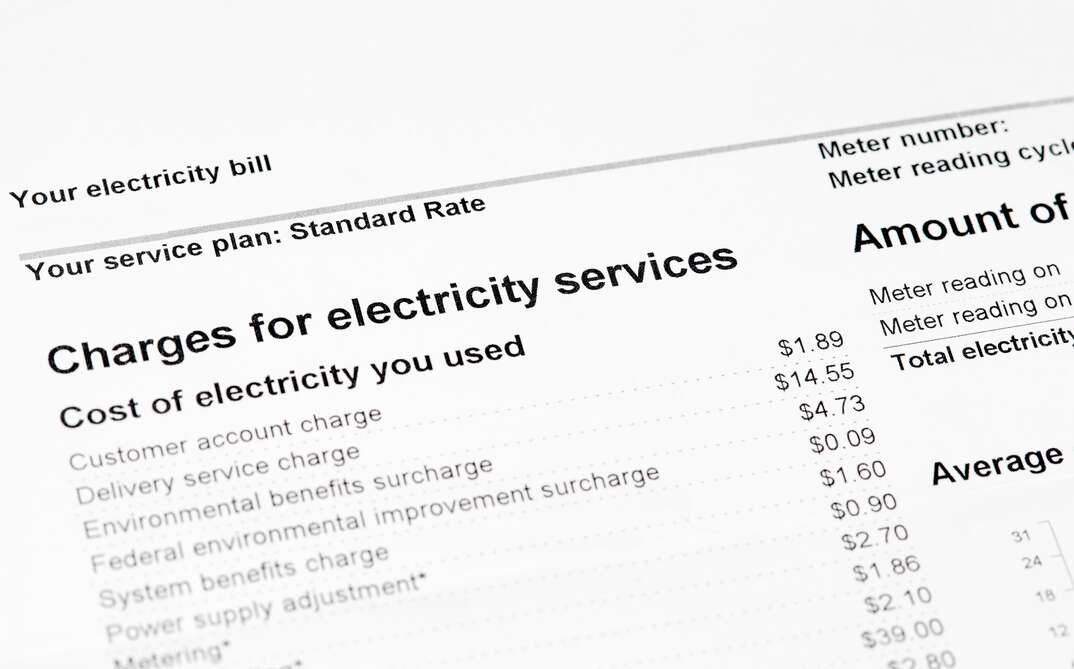

Why Is My Electric Bill so High?

Is your electricity bill much higher this month than it's been in previous months? Discover some reasons your utility cost may have shot up.

Your Guide to an Eco-Friendly Move

Make a move that's a little easier on the earth with eco-friendly techniques, such as using green movers and finding reusable moving boxes. Here are tips to help make your move more “green.”

Will Paying Off My Car Hurt My Credit Rating?

If you’re in the financial position to do so, you may be wondering if paying off a car loan early can hurt your credit. Here are the facts you need to make an informed decision about your auto loan.