- AppliancesElectriciansHVACLandscapingLocksmithPest ControlPlumbingRenovationRoofingT V RepairAll Home Improvement

- Car AccidentClass ActionCorporate LawCriminal DefenseDivorce LawEmployment LawFamily LawFinancial LawLegal AidMedical Injury LawyersMedical MalpracticeReal Estate LawWater Fire RestorationAll Legal

- InvestmentRetirementAll Finance

- Animal InsuranceAutoGeneral InsuranceHealth PolicyHome RentersAll Insurance

- DentalHealth SpecialistsAll Medical

- Animal CareVeterinaryAll Pets

- Auto GlassTowingAll Automotive

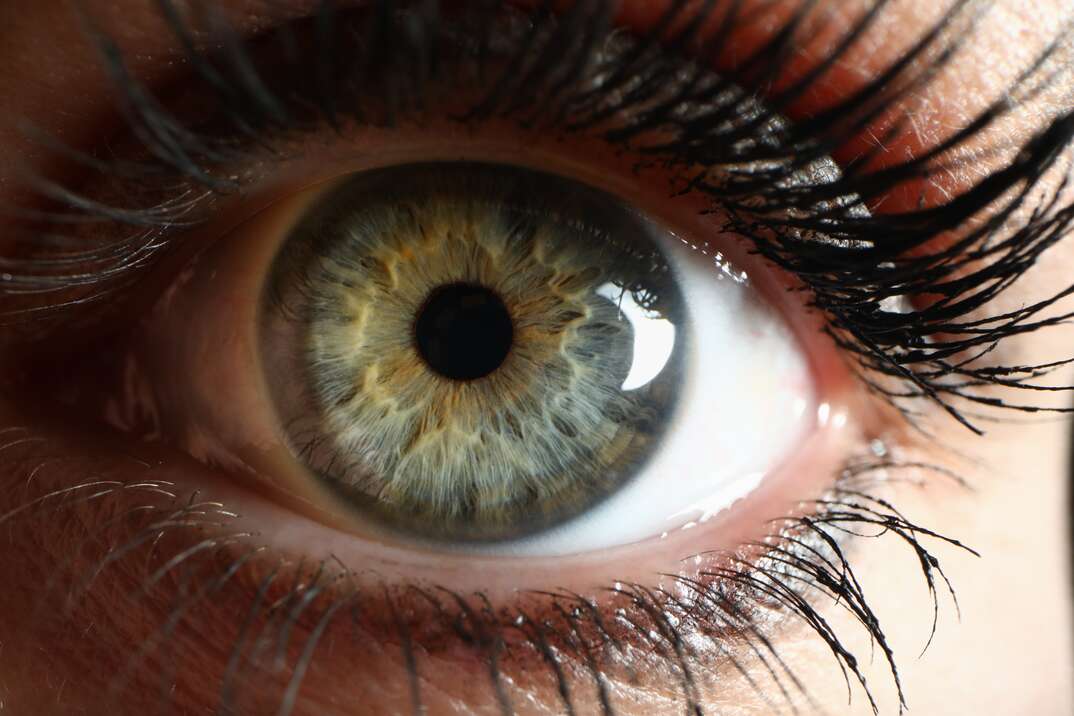

How Much Does Vision Insurance Cost?

Do you have to squint to read the fine print on packages? Vision problems are common and sometimes get worse with age. No matter how bad your vision is, having regular checkups to ensure your prescription is correct can help you see better.

People with vision issues can benefit from having vision coverage if it's an affordable plan. Here’s a breakdown of the cost factors.

According to Investopedia, the average vision insurance cost is $5 to $15 monthly in premiums for one person. You might also have to pay deductibles or copays when you use your vision insurance.

Are Vision Insurance Premiums Separate From Medical Insurance?

Some regular health insurance plans offer at least some vision coverage. However, others don't cover any vision care. Health Insurance Marketplace plans are required to offer vision care coverage for children, but the coverage isn't required for adults. It might only cover some services, such as just the exam, or it might also cover glasses or contacts. If your plan offers coverage for eye care, it's included as part of your normal premiums. For plans that don't incorporate this coverage, you'll have to buy a separate policy for an additional cost.

Your vision insurance premiums can vary based on the details of the plan. Some vision insurance cost factors include:

- Plan type: Vision insurance can be a PPO or an HMO. HMO plans usually have lower premiums, but you might pay for more of your vision care out of pocket.

- Coverage type: How much the plan pays and how much it covers determines how much you'll pay for the policy. The more it covers, the higher your premium will be.

- Insurance company: The rates you pay for vision insurance can vary depending on the company. Some charge more than others for similar coverage amounts.

Because the premiums can vary significantly, it's best to get quotes for various eye insurance plans. This can give you an idea of what's available and what fits your budget. Compare what's covered with each plan and how much you could save on vision care to help you choose the best policy.

More Related Articles:

- What’s a Pre-Existing Condition?

- What’s a Deductible?

- What Is an Insurance Premium?

- What’s the Difference Between In-Network and Out-of-Network?

- What Is a Copay?

Is Vision Insurance Worth the Cost?

Before buying a separate vision insurance plan, review your health insurance coverage to see if it pays anything for vision care. If it's already covered in your health insurance premium, it's likely not worth the extra expense of buying a separate vision insurance plan.

If your health insurance doesn't offer any vision coverage, deciding if a vision insurance policy is worth the cost depends on your situation. You're more likely to benefit from it if you go to the eye doctor regularly and need corrective lenses. To make the policy worth the expense, ensure the coverage options fit your situation. For example, if you wear contacts and don't plan on buying a pair of glasses, a plan that only offers a discount on glasses likely isn't worth it for your situation.

When deciding if the vision insurance cost is worth it, estimate how much you spend each year on eye exams and corrective lenses. Calculate how much you would save on those costs based on the coverage the vision insurance provides. For instance, if your eye exams usually cost $80 and the plan has a $15 copay for exams, you'll save $65 on each exam. If you get a percentage off glasses and contacts or get a reimbursement up to a certain amount, you'll save that additional money. Total up the premiums for the year to determine if you'll save more than you'll pay in premiums.

For some people, paying a small premium each month to get cheaper vision services is more affordable than coming up with a large chunk when they need vision care. It can be difficult to come up with the full amount for an exam if you're paying out of pocket, especially if you're also buying new glasses or contacts.

Elocal Editorial Content is for educational and entertainment purposes only. Editorial Content should not be used as a substitute for advice from a licensed professional in your state reviewing your issue. The opinions, beliefs and viewpoints expressed by the eLocal Editorial Team and other third-party content providers do not necessarily reflect the opinions, beliefs and viewpoints of eLocal or its affiliate companies. Use of eLocal Editorial Content is subject to the

Website Terms and Conditions.The eLocal Editorial Team operates independently of eLocal USA's marketing and sales decisions.