- AppliancesElectriciansHVACLandscapingLocksmithPest ControlPlumbingRenovationRoofingT V RepairAll Home Improvement

- Car AccidentClass ActionCorporate LawCriminal DefenseDivorce LawEmployment LawFamily LawFinancial LawLegal AidMedical Injury LawyersMedical MalpracticeReal Estate LawWater Fire RestorationAll Legal

- InvestmentRetirementAll Finance

- Animal InsuranceAutoGeneral InsuranceHealth PolicyHome RentersAll Insurance

- DentalHealth SpecialistsAll Medical

- Animal CareVeterinaryAll Pets

- Auto GlassTowingAll Automotive

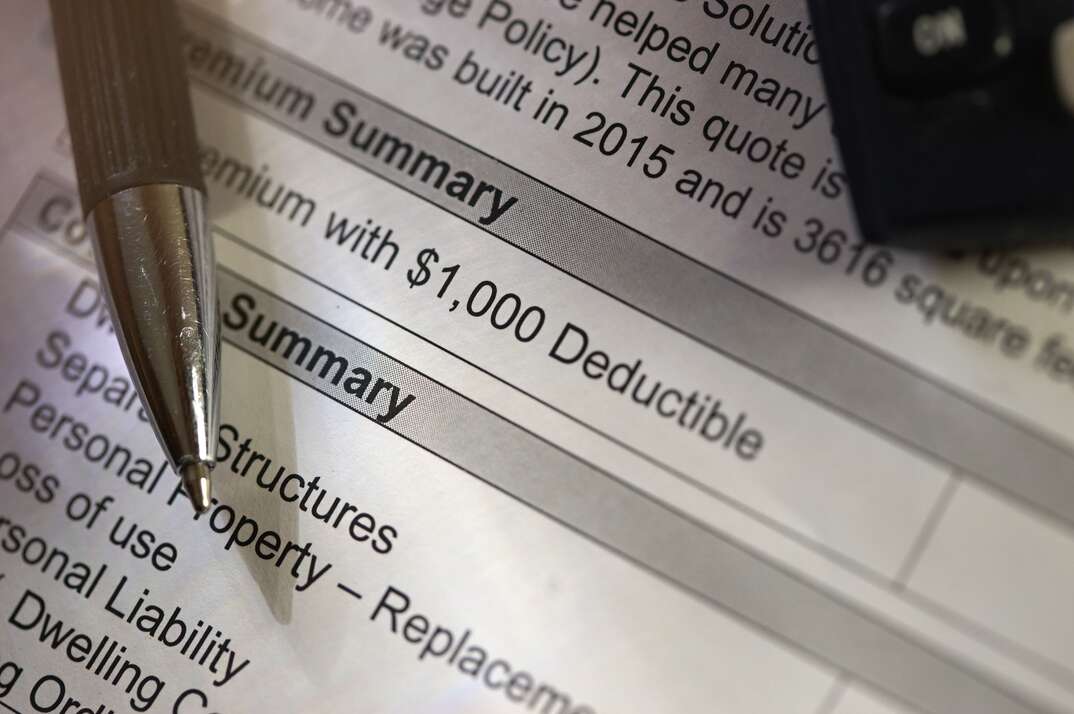

What's a Deductible?

What’s a deductible? That’s probably one of the most common terms thrown around when it comes to any kind of insurance coverage — not just health insurance.

Healthcare coverage can be confusing. What you need to pay to receive healthcare services — or what you owe after receiving those services — isn't always clear. Understanding health insurance deductibles and how they work can prepare you for expenses when you use your coverage.

The deductible is the portion of a covered healthcare service that you pay before your health insurance starts to pay for services. In other words, you have to reach your deductible before the insurance company starts paying for your healthcare services.

Your health insurance has a set deductible for the year. If you have a family health insurance plan, it will likely have individual deductibles and a family deductible. Even after you reach your deductible, you might still have to pay a portion of the bills you receive in the form of copayments and coinsurance.

However, your health insurance company might pay for some services without you paying your deductible first. For example, most healthcare insurance covers preventative care in full without you meeting your deductible. There might also be other specific services that don't require you to meet your deductible before the insurance company pays their portion. Some plans allow you to see your primary care provider for a small copayment before you reach your deductible.

How Deductibles Work

Say the deductible amount is $1,000 for the year. When you receive healthcare services, you'll pay for the first $1,000, and then your insurance company will start paying their portion. For example, if you're having surgery, you'll pay for the first $1,000 of bills related to that surgery. After the first $1,000, you'll share the cost with the insurance company, often through coinsurance. Your plan might cover 80% of the remaining costs, while you pay for 20%. You only have to reach your deductible once per year. After that, your insurance company will automatically pay its portion for all future healthcare services.

Every health insurance plan has a set deductible. You can shop around for different healthcare coverage with a lower deductible if you get your insurance on your own. If you're covered through work, you're limited to the plans they offer. Keep in mind that lower-deductible plans will have higher monthly premiums. If you are shopping around, you should try to find a balance of affordable monthly premiums and a deductible you want.

Elocal Editorial Content is for educational and entertainment purposes only. Editorial Content should not be used as a substitute for advice from a licensed professional in your state reviewing your issue. The opinions, beliefs and viewpoints expressed by the eLocal Editorial Team and other third-party content providers do not necessarily reflect the opinions, beliefs and viewpoints of eLocal or its affiliate companies. Use of eLocal Editorial Content is subject to the

Website Terms and Conditions.The eLocal Editorial Team operates independently of eLocal USA's marketing and sales decisions.