- AppliancesElectriciansHVACLandscapingLocksmithPest ControlPlumbingRenovationRoofingT V RepairAll Home Improvement

- Car AccidentClass ActionCorporate LawCriminal DefenseDivorce LawEmployment LawFamily LawFinancial LawLegal AidMedical Injury LawyersMedical MalpracticeReal Estate LawWater Fire RestorationAll Legal

- InvestmentRetirementAll Finance

- Animal InsuranceAutoGeneral InsuranceHealth PolicyHome RentersAll Insurance

- DentalHealth SpecialistsAll Medical

- Animal CareVeterinaryAll Pets

- Auto GlassTowingAll Automotive

How to File an Insurance Claim for Water Damage

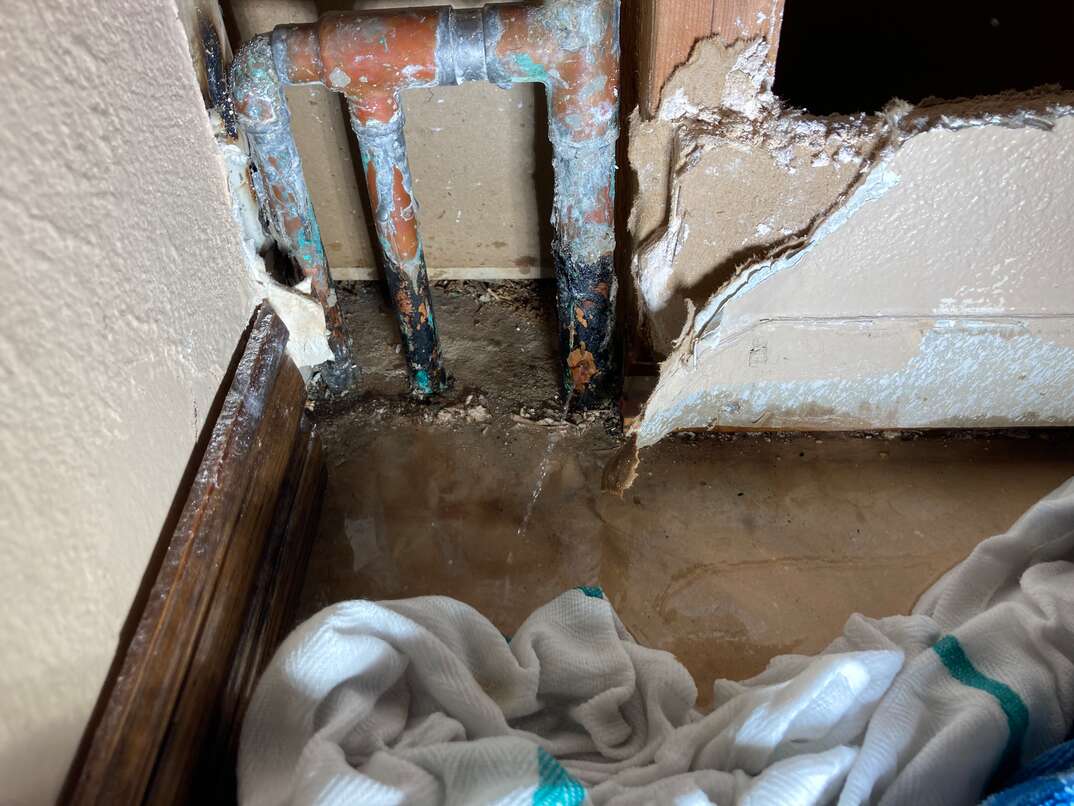

Dealing with water damage can be overwhelming, especially if you're adding an insurance claim into the mix.

Read More About Homeowners Insurance

If you experience a significant loss due to water in your home, filing a water damage insurance claim can help you recover financially. Here’s what to expect during the claims process.

Deciding whether to file a water damage insurance claim depends on the specifics of the situation. First, make sure the type of water damage you have is covered by your homeowners insurance. You don't want to file a claim if you already know it will be denied.

Then, consider the amount of damage you have and your insurance deductible. Homeowners insurance deductibles typically range from $250 to $5,000 (CAD 330 to CAD 6,650).

Some policies set the deductible as a percentage of the insured value of your home, such as 1% of the insured amount. For coverage levels of $450,000 (CAD 600,000), your deductible would be $4,500 (CAD 6,000). If you have a higher insurance deductible and minor water damage, you might decide to handle the damage yourself and skip the homeowners insurance claim.

If repairing the water damage will cost just a little more than your deductible, you still might choose to pay out of pocket instead of filing a water damage insurance claim, especially if you've filed other claims on your homeowners policy. The company may decide not to renew your policy if you have multiple claims or even if you have just one large claim. If the damage is significant and will cost a lot more than your deductible to repair, filing a claim could be worth it financially, assuming the source of the damage is covered. If you get a nonrenewal when your policy expires, you can shop around with other insurance companies to get new coverage.

What Types of Water Damage Are Typically Covered?

Both sudden and accidental water damage is usually covered by homeowners insurance. This means it has to be unexpected. If you've neglected your roof for years and you have a leak, it likely won't be covered since you didn't maintain it. Some of the types of water damage that are usually covered include:

- Frozen and burst pipes

- Roof leaks from sudden damage, such as a tree falling in a storm

- Ice dams

- Appliance or plumbing leaks

- Vandalism

- Water damage from putting out a fire

You won't usually have a homeowners or renters insurance claim approved for water damage from the following causes:

- Floodwater

- Groundwater in your basement

- Water damage to your pipes or roof caused by a lack of maintenance

- Sewer backups if your policy doesn't have a special endorsement for this type of damage

- Mold — if it's not related to a covered incident

- Replacing the source of the leak, such as replacing a washing machine that flooded your home

Flood damage outside your home isn't covered under a regular homeowners or renters insurance policy. You must have a separate flood insurance policy on your property to have the damage covered.

More Related Articles:

- 7 Clauses to Look Out For in Your Homeowners Insurance Policy

- What’s a Deductible?

- Insurance Terms, What Is an Act of God?

- What Is an Insurance Premium?

- What’s the Difference Between Homeowners and Renters Insurance?

If you decide you want to file a water damage insurance claim, file it as quickly as possible to initiate the process. It takes some time to get things moving, so the sooner you file the claim, the sooner the work can begin.

To file a claim, contact your homeowners or renters insurance company or the insurance agent that handles your policy. You can often call or file a claim online. The process typically looks like this:

- You'll enter all relevant information about the water damage to open the claim. Give as much detail as possible to make the process go faster.

- The insurance company will review the claim and let you know if they need additional information or documentation. Respond as quickly as possible to get your repairs fixed sooner, rather than later.

- An insurance adjuster will then look into the claim. Sometimes an adjuster will come to your home to look at the damage in person. They'll document the damage to determine the extent. They might also ask questions about the water damage to help determine if it qualifies and how much the company will pay for the repairs. Other companies might simply ask you to submit photos of the damage.

- Your insurance company comes up with an estimate for the repairs and sends you a written estimate.

- You'll get a check for the amount of the repairs, which you can use to pay the contractors.

- You can find the right contractors to handle your repairs and get the work started.

After initially filing your claim, take photos to document the damage. You might need to make some temporary repairs or some cleanup to prevent additional damage while you wait for the insurance company to get back to you. Keep receipts and document anything you do to fix the issue.

All CAD conversions are based on the exchange rate on the date of publication.

Elocal Editorial Content is for educational and entertainment purposes only. Editorial Content should not be used as a substitute for advice from a licensed professional in your state reviewing your issue. Systems, equipment, issues and circumstances vary. Follow the manufacturer's safety precautions. The opinions, beliefs and viewpoints expressed by the eLocal Editorial Team and other third-party content providers do not necessarily reflect the opinions, beliefs and viewpoints of eLocal or its affiliate companies. Use of the Blog is subject to the

Website Terms and Conditions.The eLocal Editorial Team operates independently of eLocal USA's marketing and sales decisions.