- AppliancesElectriciansHVACLandscapingLocksmithPest ControlPlumbingRenovationRoofingT V RepairAll Home Improvement

- Car AccidentClass ActionCorporate LawCriminal DefenseDivorce LawEmployment LawFamily LawFinancial LawLegal AidMedical Injury LawyersMedical MalpracticeReal Estate LawWater Fire RestorationAll Legal

- InvestmentRetirementAll Finance

- Animal InsuranceAutoGeneral InsuranceHealth PolicyHome RentersAll Insurance

- DentalHealth SpecialistsAll Medical

- Animal CareVeterinaryAll Pets

- Auto GlassTowingAll Automotive

What's a Good Credit Score?

Reviewed by Elizabeth Marcant, finance expert

Before you make a big purchase, it's worth thinking about how your spending habits are likely to affect your credit. A good credit score makes it easier to qualify for loans, credit cards and mortgages, making it an important financial resource. But what is a good credit score?

It depends on which scoring system you use, but anything over 700 is usually considered “good.” If you're not there just yet, it's possible to increase your credit score by developing good financial habits.

FICO® and VantageScore both offer various credit scoring models. These scores are calculated based on these factors:

- Payment history

- Amounts owed

- Length of credit history

- Credit mix

- New credit

Payment History and Amounts Owed

Payment history and amounts owed are the most important factors, as they account for around 65% of your score with either credit scoring model. Your payment history tells creditors whether you have a history of on-time payments. The amount owed refers to the balances on your credit accounts. Creditors typically like to see utilization levels below 30%. Utilization refers to how much credit you're using compared to how much credit you have. If you have $20,000 in credit and use $1,000 of it, then your utilization is 5%.

Length of Credit History and Credit Mix

When determining the length of your credit history, the credit scoring models consider your average age of accounts, the age of your newest account, the age of your oldest account and how long it's been since you've used certain types of accounts. This accounts for around 15% of your scores. Credit mix refers to how many types of credit accounts you have. Your credit mix may include credit cards, installment loans, retail accounts or mortgage loans. Credit mix accounts for 10% of your score.

New Credit

The final piece of the puzzle is new credit, which refers to how many new accounts you've opened recently, how long it's been since you opened a new credit account and how many inquiries are on your credit reports. Too many inquiries or new accounts in a short amount of time may indicate that you're struggling to pay your bills and opening credit accounts to make up the difference, making creditors view you as a high-risk borrower. New credit accounts for around 10% of your scores.

What Is a Good Credit Score?

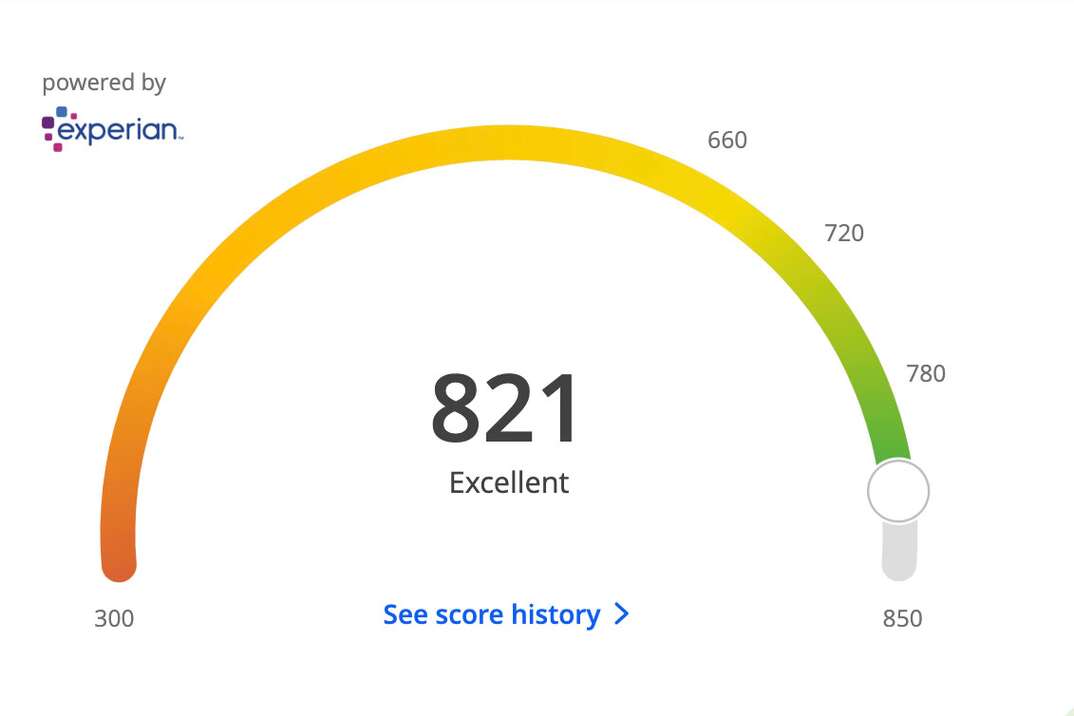

For credit scoring models with ranges of 300 to 850, a score above 700 is usually considered good or excellent. Some companies break good scores into two ranges: good and very good. For example, Equifax considers scores of 670 to 739 as good and scores of 740 to 799 as very good.

What's an Excellent Credit Score?

Some consumers have excellent credit scores due to their good financial habits. If a scoring system ranges from 300 to 850, any score of 800 and above is usually considered excellent.

What's the Average Credit Score?

In the United States, consumers have an average credit score of 714. This average is based on FICO scores, so the average may vary if you're looking at other credit scoring models. Older consumers tend to have the highest averages — 740 for baby boomers versus 679 for Gen Z consumers.

Bad credit refers to a FICO score below 670, although some models and creditors consider credit scores between 580 and 669 to be fair or poor and scores under 580 to be bad or very bad. If you have low credit scores, don't despair. In some cases, low scores are simply due to a lack of credit history. As you open new accounts and manage them responsibly, your scores will increase over time.

If your scores are low due to a history of late payments, high balances or too many new accounts in a short period of time, it's possible to increase them by developing good financial habits.

The following factors have a negative impact on your credit scores:

- Late payments

- Missed payments

- Charge-offs

- Foreclosures

- Bankruptcies

- Collection accounts

- Applying for too many new accounts

- High credit utilization

Charge-Offs

A charge-off is an account that's written off as bad debt after a creditor attempts to get you to pay on the account as agreed. Charge-offs — along with late payments and missed payments — stay on your reports for up to 7 years, so they have a major impact on your credit scores. However, the impact of any negative item on your report diminishes as time goes by.

To avoid low scores due to late payments, missed payments and charge-offs, pay your bills on time. If you have trouble remembering payment due dates, set up auto-pay and make sure you have enough money in the bank to cover your minimum payments each month.

Inquiries

Inquiries typically affect your credit scores for one year, but they stay on your reports for two years. The best way to avoid a score drop due to too many inquiries is to avoid applying for credit unless you really need it. You should generally avoid applying for multiple credit accounts within a matter of weeks or months. The exception is with auto loans and mortgages. Lenders know you may want to shop around for good rates, and the credit scoring models treat multiple applications for an auto loan or mortgage in a short period of time as one for the purposes of how the inquiries impact your score.

What Are the Lowest and Highest Credit Scores Possible?

Most FICO scores range between 350 and 800, but some variations range from 250 to 900. These variations include The FICO Bankcard Score and the FICO Auto Score. The Bankcard Score is designed to predict a borrower's risk of defaulting on a credit card account, while the Auto Score is designed to predict a borrower's risk of defaulting on an auto loan.

Elocal Editorial Content is for educational and entertainment purposes only. The information provided on this site is not legal advice, and no attorney-client or confidential relationship is formed by use of the Editorial Content. We are not a law firm or a substitute for an attorney or law firm. We cannot provide advice, explanation, opinion, or recommendation about possible legal rights, remedies, defenses, options or strategies. The opinions, beliefs and viewpoints expressed by the eLocal Editorial Team and other third-party content providers do not necessarily reflect the opinions, beliefs and viewpoints of eLocal or its affiliate companies. Use of the Blog is subject to the

Website Terms and Conditions.The eLocal Editorial Team operates independently of eLocal USA's marketing and sales decisions.