- AppliancesElectriciansHVACLandscapingLocksmithPest ControlPlumbingRenovationRoofingT V RepairAll Home Improvement

- Car AccidentClass ActionCorporate LawCriminal DefenseDivorce LawEmployment LawFamily LawFinancial LawLegal AidMedical Injury LawyersMedical MalpracticeReal Estate LawWater Fire RestorationAll Legal

- InvestmentRetirementAll Finance

- Animal InsuranceAutoGeneral InsuranceHealth PolicyHome RentersAll Insurance

- DentalHealth SpecialistsAll Medical

- Animal CareVeterinaryAll Pets

- Auto GlassTowingAll Automotive

How Are the Three Credit Bureaus Different?

Jennifer Wills, independent financial coach

Have you ever been denied credit due to your credit score? Or maybe you're on the other end of the spectrum and got a super low interest rate on a loan due to your credit score.

Credit bureaus are responsible for calculating the scores that impact credit decisions from lenders. Knowing a little bit about how these bureaus work can help you better understand how they can impact your finances.

Credit bureaus keep track of your credit history and calculate a three-digit credit score. The bureaus pull your financial information from various sources to create credit reports about you. While these bureaus are private companies, the Fair Credit Reporting Act heavily regulates how they collect and use your information.

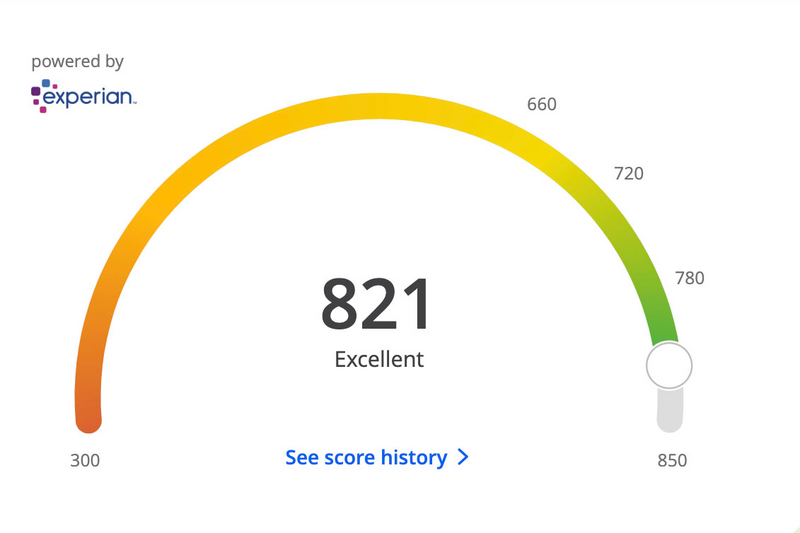

When you apply for new credit, start new utilities, switch cell phone companies or try to rent an apartment, these companies can check your credit score through one or more of the credit bureaus. This gives the companies an idea of your creditworthiness based on a score from 300 to 850. The credit scores reported can impact whether you're approved, the interest rates you get and the deposit amounts required.

The Three Major Credit Bureaus

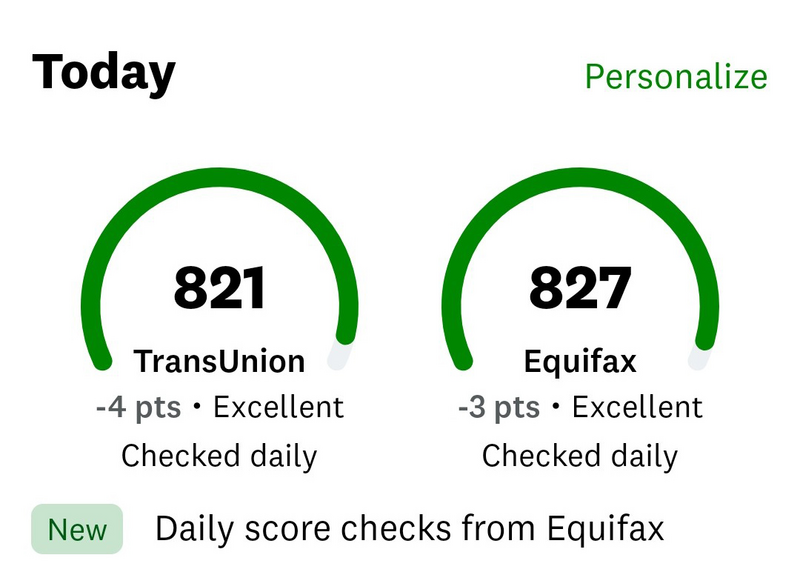

In the U.S., the three main credit bureaus are Experian, TransUnion and Equifax. Although they all collect similar information about all consumers, there often are slight differences in the reports and scores among the three bureaus.

All three major credit bureaus are used to make credit decisions. However, Equifax tends to have a stronger presence in the Midwest and in the South. Experian started as a bureau for states in the West, but it's now popular across the country.

Some lenders might prefer one of the credit bureaus over the other two, but you often won't know that ahead of time. In fact, you might never find out unless your application is denied. In that case, you'll receive a letter with the information about your credit score that caused you to get denied.

Since any of the three main bureaus could be used, it's important to keep an eye on all of them. Make sure each report is accurate to avoid mistakes that lower your score. If your lender uses a credit bureau that shows a lower score than the others, it could negatively affect your loan eligibility or interest rate.

How Do They Differ in Their Credit Reporting?

If all three credit bureaus collect the same information about you and use similar calculation methods, why can your scores vary slightly? One reason is that some lenders don't report to all three credit bureaus. That means one or two agencies might not have data from that lender. If that account is past due, it could lower your score with the bureau it's reported to, or if it's in good standing, it could raise your score with that bureau.

Even if a lender reports to all three agencies, the most recent information might not show up to the agencies at the same time. If a delinquency is reported to one agency first, that score might drop sooner than the score with other bureaus.

The information could also be reported inaccurately to one of the credit bureaus. This is why it's important to review all the information with all three bureaus to ensure accuracy. If you notice an error, directly contact that credit bureau to get it fixed.

If you have a dispute with multiple bureaus, each bureau could resolve it at a different time. When one bureau fixes the mistake, your credit score there should increase. However, your scores with the other two organizations might remain lower until the disputes are resolved with them.

What Information Do Credit Bureaus Collect?

Credit bureaus collect data related to your credit and bill payment habits using information reported by creditors. Your credit report with each bureau includes your personal information to ensure the correct credit history is assigned to you. This includes your name, contact information and Social Security number.

The credit report itself includes lots of information about your credit accounts. Things that go into your credit score include:

- Account balances

- Available credit

- Account status

- Payment history, including late payments and delinquencies

- Bankruptcies

- Foreclosures

Each time your creditors report new information in these areas, your credit score updates and your credit report reflects the latest actions. The data stays on your credit report for a long time — usually seven years. Working to improve your credit with on-time payments and low balances can help improve your score and increase your chances of getting approved for credit when you need it.

Elocal Editorial Content is for educational and entertainment purposes only. The information provided on this site is not legal advice, and no attorney-client or confidential relationship is formed by use of the Editorial Content. We are not a law firm or a substitute for an attorney or law firm. We cannot provide advice, explanation, opinion, or recommendation about possible legal rights, remedies, defenses, options or strategies. The opinions, beliefs and viewpoints expressed by the eLocal Editorial Team and other third-party content providers do not necessarily reflect the opinions, beliefs and viewpoints of eLocal or its affiliate companies. Use of the Blog is subject to the

Website Terms and Conditions.The eLocal Editorial Team operates independently of eLocal USA's marketing and sales decisions.